Super Support Measures

The Government recently further support measures, this time in the area of Superannuation.

Temporary early access to Superannuation

Eligible individuals will be able to apply to access up to $10,000 of their superannuation before 1 July 2020.

They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

Am I eligible to apply?

To apply for early release you must satisfy any one or more of the following requirements:

• you are unemployed; or

• you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

• on or after 1 January 2020: you were made redundant; or your working hours were reduced by 20 per cent or more; or if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or more.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

How to apply for early access

You can apply directly to the Australian Taxation Office (ATO) through the myGov website: www.my.gov.au.

If you currently draw a pension from your Super Fund, there has been a change in drawdown requirements.

Reduction in Superannuation Minimum Pensions

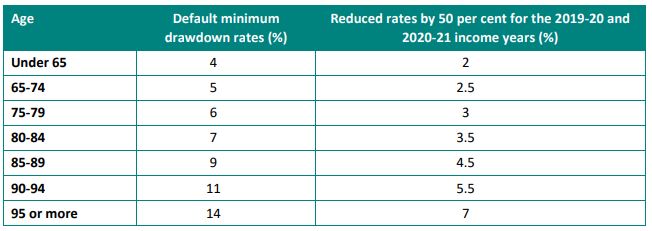

The Government is temporarily reducing superannuation minimum drawdown requirements for account-based pensions and similar products by 50 per cent for the 2019-20 and 2020-21 income years.

There is also a reduction in both the upper and lower social security deeming rates by a further 0.25 percentage points in addition to the 0.5 percentage point reduction to both rates announced on 12 March 2020.

Temporary Reduction in Super Min. Drawdown Requirements

This measure will benefit retirees with account-based pensions and similar products by reducing the need to sell investment assets to fund minimum drawdown requirements. The reduction applies for the 2019-20 and 2020-21 income years.

This measure will have no impact on the underlying cash balance for 2019-20 and a negligible impact in 2020-21.

Please note, these are proposed changes only and are still to be legislated.

Changes to Social Security Deeming Rates

As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent.

The reductions reflect the low interest rate environment and its impact on the income from savings.

The change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $105 more from the Age Pension in the first full year that the reduced rates apply.

The changes will be effective from 1 May 2020.

These are challenging times. If you have any queries, please contact us to speak with one of our experienced Accountants tel: 5221 7655.

This is is a general summary only. For more information, please speak with your Accountant.

Find us elsewhere